Learn About Credit Unions

You are more than a member, you are part owner.

Credit unions are not-for-profit organizations that exist to serve their members. Like banks, credit unions accept deposits, make loans and provide a wide array of other financial services. Credit unions are owned and controlled by the people, or members, who use their services. Your vote counts. A volunteer board of directors is elected by members to manage a credit union. Credit unions operate to promote the well-being of their members. Profits made by credit unions are returned back to members in the form of reduced fees, higher savings rates and lower loan rates. Members of a credit union share a common bond, also known as the credit union’s “field of membership.” You may be able to join based on your employer, family, geographic location or membership in a group.

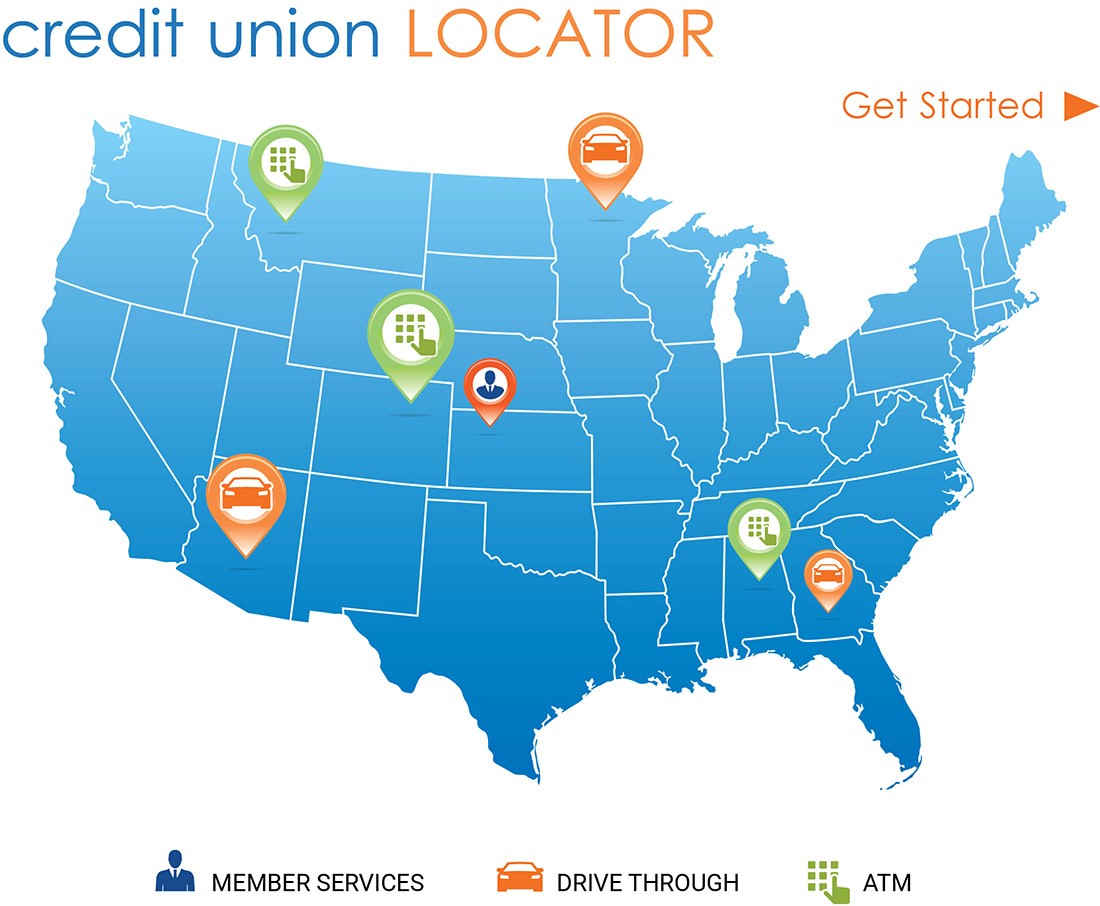

Infographic

Infographic