Credit Card Payments

When your monthly statement comes, there’s a natural tendency to pay only the minimum amount due. Don’t do it! Read your statement carefully for information about how long it would take to pay off your account balance if you only pay the minimum payment. It can take years, even decades, to pay off high balances. If possible, pay the balance off in full every month, or at the very least try to pay more than the minimum amount. Doing so will help you establish a good credit rating. This is a score or number used by lenders to determine the interest rate you will pay on your loan.

TIP: If you can’t pay off your balance every month, determine which of your cards have the highest interest rates and try to pay those off first.

Paying off Credit Card Debt

Wondering how long it will take to pay off your debt? Based on the information you enter, an online credit card payment calculator can help you estimate how long it will take you to pay off your credit card balance.

-

Real World Examples

Suppose when you’re 18, you charge $1,500 worth of clothes and DVDs on a credit card with a 19% interest rate.

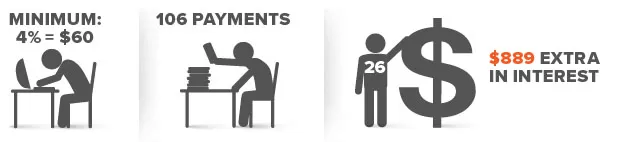

If you repay only the minimum amount each month, and your minimum is 4% of the outstanding balance (the lowest amount permitted by some issuers), you’ll start with a $60 payment. You’ll be more than 26 years old by the time you pay off the debt. That’s 106 payments, and you will have paid more than $889 extra in interest. And, that’s if you charge nothing else on the card, and no other fees are imposed (for example, late charges).

If your minimum payment is based on 2.5% of the outstanding balance, you’ll start with a $37.50 payment. You’ll be over 35 years old when you pay off the debt. That’s 208 payments, and you will have paid more than $2,138 in interest, even if you charge nothing else on the account and have no other fees.

-

Paying Off Credit Cards

When your monthly statement comes, there’s a natural tendency to pay only the minimum amount due. Read your statement carefully for information about how long it would take to pay off your account balance if you only pay the minimum payment. This could be years, or even decades if it is a high balances. Learn how to approach paying off your credit cards.

-

Keep Credit Card Use Under Control

Whether you shop online, by telephone, or by mail, a credit card can make buying things much easier. But when you use a credit card, it’s important to keep track of your spending. Incidental and impulse purchases add up. When the bill comes, you have to pay what you owe. Owing more than you can afford to repay can damage your credit rating. Keeping good records can prevent a lot of headaches, especially if there are inaccuracies on your monthly statement. If you notice a problem, report it immediately to the company that issued the card. Usually the instructions for disputing a charge are on your monthly statement.

If you use your credit card to order online, by telephone, or by mail, keep copies and printouts with details about the transaction. These details should include the company’s name, address, and telephone number; the date of your order; a copy of the order form you sent to the company or a list of the stock codes of the items you purchased; the order confirmation code; the ad or catalog from which you ordered (if applicable); any applicable warranties; and the company’s return and refund policies.

-

Security Tips and More Information

If you use a credit card, charge card, or debit card, take several precautions. Never lend the card to anyone unsupervised. Never sign a blank charge slip. Draw lines through blank spaces on charge slips above the total so the amount can’t be changed. Never put your account number on the outside of an envelope or on a postcard. Always be cautious about disclosing your account number over the telephone, unless you know the person you’re dealing with represents a reputable company.

Carry only the cards you expect to use to reduce potential loss or theft. Always report lost or stolen credit cards, charge cards, and debit cards to the card issuers as soon as possible. Follow up with a letter that includes your account number, when you noticed the card was missing, and when you first reported the loss.

For more information, visit the Consumer Financial Protection Bureau’s online Consumer Tools portal – Ask CFPB – where you can get impartial answers to your credit card questions.

-

Guidelines to Avoid Credit Card Debt and Create Good Credit at the Same Time.

Know your financial means and limits, and don't go beyond them. Only charge items you know you can pay off each month. If you already carry a balance, pay more than the minimum payment (or the most you can afford) to bring down your principal balance. Try to keep your balance as low as possible. Shop around before accepting a credit card offer. Compare interest rates; they can range from reasonably low to extremely high. Carry only 1 or 2 major credit cards and avoid using your full credit limit. Read the fine print and disclosures. If you are making payments on several credit cards, you should pay off the card with the highest interest rate first.

-

Credit Card Features and Fees

Balance transfer fee – A 3% charge is not uncommon for transferring the balance on your old credit card to a new one, usually to get a lower interest rate. For every $1,000, it would cost you $30. Transfer $10,000 and you could pay $300. Look for a cap. Even with a cap, you might pay $75 or more. Decide if it's worth it to transfer your funds and pay a fee in order to get a lower rate.

Late payment fee – A card issuer is allowed to charge up to $27 for the first offense, and up to $38 for next. Some card issuers use a sliding scale, so for any balance over $1,000, you could be charged the highest fee.

Annual fee – This fee could be as high as $500, often for a rewards program. But many card issuers promote "No annual fee" to distract you from their other fees. Choose a card with a fee structure that is right for your circumstances.

Cash advance fee – This fee is often the greater of $10 or 5% of the cash advance. Want a quick $100 cash advance from an ATM? Watch out for a $10 minimum charge, since 5% of $100 is only $5. Read the cardholder agreement. And remember, cash advances usually come at a higher interest rate.

Over-limit fee – If you make charges on your credit card and exceed your approved limit, you can be socked with a hefty penalty fee. While the upper range can be as high as $38, the card issuer often uses a sliding scale.

Travel penalty – If you make purchases outside the United States, your credit card company may add a 1% currency exchange fee. Some credit unions and banks tack on an additional 2 percent. Know before you go.

Returned payment fee – If you pay your credit card bill with a check that bounces, your card issuer can impose a fee for not having enough funds to make the payment. Such action may also trigger a late payment fee if you are unable to pay the bill on time. Your financial institution may also charge an NSF fee for bouncing a check.

-

Be Aware of Uncommon Fees

A few credit card issuers charge small, miscellaneous fees for specific services provided to their cardholders. For example, an additional fee may be imposed for sending a wire transfer, using overdraft protection, stopping a payment, mailing a statement, shipping a replacement card, or reinstating an inactive account.

-

Why Reading the Fine Print Matters

A recent survey of 100 widely held cards found that credit cards have on average six fees. Your cardholder agreement typically holds all the details about fees and charges. Know your spending habits. Be as careful as you can when using a credit card. Make your payments on time. Good payment behavior is rewarded.