COVID-19 Notice: The NCUA recommends registering for the consumer complaint portal through the link below to electronically submit and receive communications from the agency. COVID-19 has many employees working remotely at this time, which has disrupted processing of traditional mail and may cause a delayed response. We are working to improve this process. You may also reach the NCUA Consumer Assistance Center at 1.800.755.1030 Monday through Friday, 8 a.m. to 5 p.m. Eastern. For additional information, visit the NCUA's COVID-19: Resources for Federally Insured Credit Unions and Members.

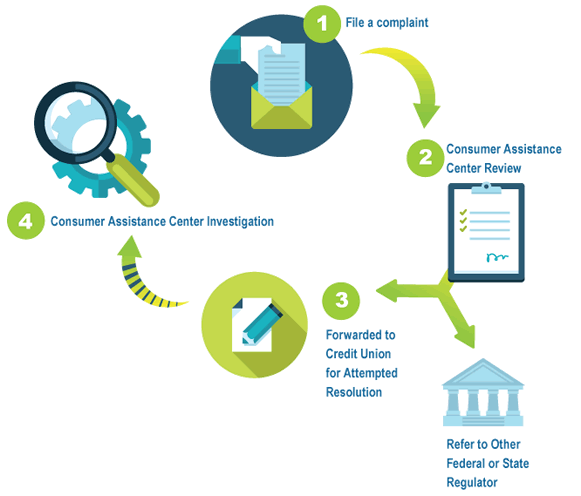

Complaint Process

If you have a complaint, first, try to resolve the problem directly with your credit union. This may involve contacting the credit union's customer service department, senior credit union management, or the supervisory committee. If you cannot resolve the issue with your credit union, you can contact NCUA’s Consumer Assistance Center for help by completing the NCUA Consumer Assistance Form (PDF version). If your complaint involves more than one issue or credit union, you will need to submit separate complaint forms for each issue or credit union. Once the form(s) has been received, you will receive an acknowledgement and additional information about the complaint process from NCUA’s Consumer Assistance Center. Learn more about the complaint process below.

- File a complaint: The complaint process begins when you submit a complaint using the online NCUA Consumer Assistance Form or the PDF version to the Consumer Assistance Center.

- Consumer Assistance Center Review: Upon receiving your complaint the Consumer Assistance Center will send you an acknowledgment that includes a case number. Thereafter, we will determine whether your complaint involves matters within NCUA's enforcement authority. If your complaint falls outside of NCUA’s regulatory enforcement authority, we will notify you that your case has been referred to the appropriate federal or state agency for handling.

- Forwarded to Credit Union for Attempted Resolution: If your complaint involves a federal consumer financial protection law or regulation within NCUA’s enforcement authority, we will forward it and any documents to the credit union for its review. The credit union may attempt to resolve your complaint within 60 calendar days of receiving your complaint. In the event that the matter is resolved and the credit union confirms this in writing to both you and the Consumer Assistance Center within the 60-day time period, the Consumer Assistance Center will close your case.

- Consumer Assistance Center Investigation: We may begin a formal investigation of the matter, if:

- The Consumer Assistance Center does not receive any written response about your complaint from the credit union within the 60-day time period;

- The credit union notifies the Consumer Assistance Center in writing that it has been unable to resolve your complaint; or

- You dispute the credit union’s assertion that your complaint has been resolved by contacting the Consumer Assistance Center in writing within 30 calendar days of the date of the credit union's response letter to you.